In this article I will share with you what a trading plan is, and give you examples of what this might look like. I will also explain to you how to create your own trading plan. I hope you find this useful.

What is a Trading Plan?

A trading plan is a plan of how to make money from the financial markets by trading – sounds obvious! There are a few components to this (which complement/feed into each other), as follows:

- Risk management

- A trading strategy

- Risk to reward ratio

I discuss each of these aspects of the overall trading plan, below.

Trading Plan: Risk management

I have provided a detailed article on risk management here:

https://trader-pro.co.uk/category/risk-management/

In short, you want to control the value of your money at risk on each trade by restricting the value to a predetermined level and by keeping this value consistent for each trade placed. In the examples provided in my risk management article, I talk about limiting risk to £100 per day as an example. It is crucial that this element of your trading is ‘under control’ as otherwise you will likely fail to become consistently profitable. By limiting your risk to 1% of your capital balance, your emotions will remain calm and your reward to risk ratio can be analysed and understood more easily. Also, keeping the amount at risk consistent between trades placed, will be an essential part of your trading strategy / it is necessary to do this for your strategy to work. (More below). Please consider the article I published on risk management, very carefully and incorporate this into your Trading Plan.

Trading Strategy

A trading strategy is the plan of how you will find and execute trades. It’s the type of trade opportunity you will look for when considering the markets. Traders can either be technical traders or fundamendal traders. Technical traders place trades by considering the price action taking place on the charts. Fundamental traders consider the market’s detailed financials by looking at financial statements, PE ratios, return on investment ratios etc. Although my professional career started as a chartered accountant, and I have the ability to understand the fundamentals of a company when considering its financial statements etc, I do not trade using fundamental data. I only trade based on what is happening on the charts and price action. Either approach can work. However, this blog is tailored towards helping you understand technical analysis (analysing the charts) and this type of trading style in particular.

Within the technical analysis you may look for particular set ups/patterns to appear on the chart. When you see the pattern you are looking for, you would then execute a trade, while controling/limiting your risk to £100 (or whatever value you choose) in the event the trade goes against you, per the risk management plan. You would typically look to make a bit more than your ‘at risk’ value whenever you make a profit.

There are many different types of trading strategies based on technical analysis which work. You may have found one already and you have come here to understand how the strategy fits into an overall trading plan. Or perhaps you are completely new to trading and you need to start at the beginning. Many traders use different types of indicators to signal to them where to enter a market or exit. This will be a key part of their trading strategy. For example, some traders like to use Bollinger bands. I have provided a screen shot below of what these look like:

I do not use this strategy (not for any other reason other than I haven’t learnt to use it yet and traders typically find a niche and stick to what they know). Some traders would use this indicator to enter the market at a particular place within the blue bands and aim to exit at the top of the bands to get a profit and they might set their stop loss or exit the trade in a loss scenario, near the bottom of the bands. This is just one type of example of how the indicators can be used to plan entry and exit points.

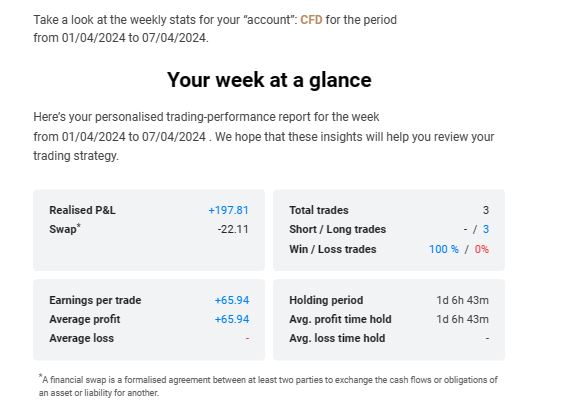

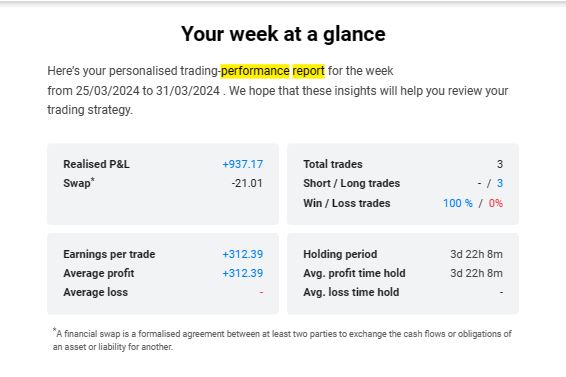

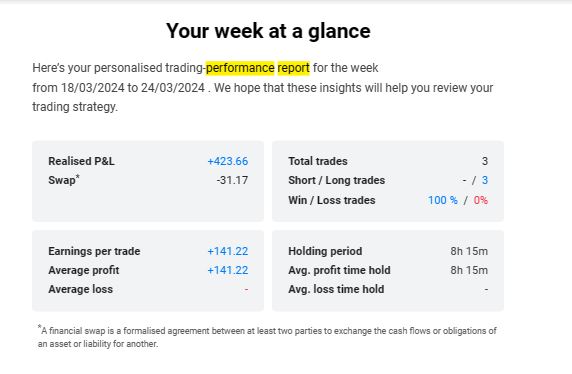

In my own trading style, I use a ‘buy the dip’ strategy. I achieve a 60% win rate with this strategy and I get roughly a 1.5:1 reward risk ratio (more below). If you would like to see how my strategy works, please visit my Patreon page here:

https://www.patreon.com/collection/485557

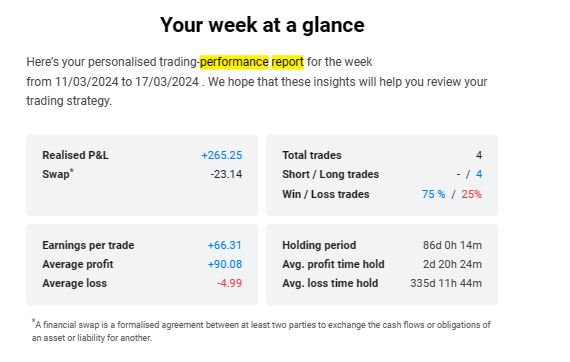

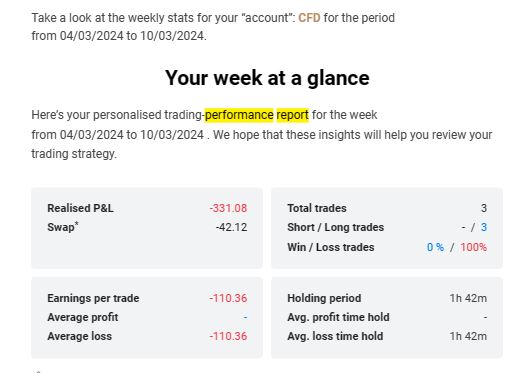

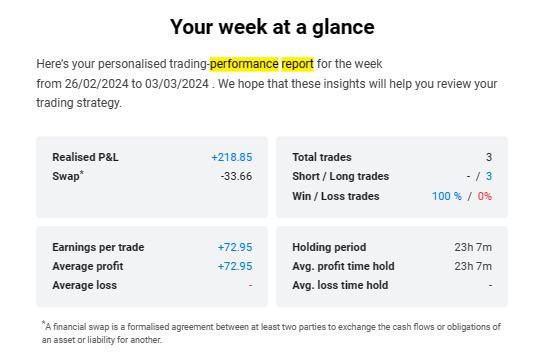

You can learn about different strategies from traders on You Tube and see what suits you best. I would advise you to ensure you can trust the person teaching you. There are many people on the internet which lead new inexperienced traders into losing money! I used to be one of these. I provide assurance over what I write in my blog articles by publishing my win rate, as confirmed in reports from my broker. I also publish my weekly profits and losses. Please see this section of my blog:

https://trader-pro.co.uk/category/my-performance-statistics/

Once you have found a strategy that you believe works and you can trust, you want to make sure that it has a good risk to reward ratio, and that the risk to reward ratio works with the overall win rate – more below. You should have an idea of the win rate of the strategy you want to follow from the person who taught you the strategy. As I said above, in my buy the dip strategy , the win rate is roughly 60%.

Risk to Reward Ratio

What is risk to reward ratio? This ratio is the ratio of profit to loss when you are controlling your trades in accordance with what is discussed on the risk management page of this blog. The risk to reward ratio can vary between trading strategies. For example, a ‘break out’ strategy can achieve high reward to risk ratios. (I’m not a break out trader so I could not advise you of the win rate of these types of strategies). In the trading strategy I teach on Patreon, the reward to risk ratio is roughly 1.5:1, respectively. This means, for every trade I place, I look to make, lets say, either £100 as a loss or £150 as a profit.

It is the combination of risk to reward ratio as well as your win rate, which will determine whether or not the overall strategy works and is profitable. Here is an example based on the strategy I follow personally:

My strategy (linked below):

https://www.patreon.com/collection/485557?view=expanded

Win rate: 60%

Reward/risk ratio: 1.5:1

Every 10 trades placed will, on average, have the following outcome:

6 will be profitable – with a value of £900 (60% x 10 trades x £150 profit = £900)

4 will be losses – with a value of £400 (40% x 10 trades x £100 loss = £400)

Therefore over the course of 10 trades, I would expect to make circa £500 with this strategy.

As explained in the risk management article, the level of risk will be set by your account balance size… (typically 1% of your entire balance) but it is the ratio of profit to loss and the win rate which are important and these can be applied to any account size.

Lets consider an example with a great reward risk ratio but a poor win rate:

Win rate: 20%

Reward/risk ratio: 4:1

Every 10 trades placed will, on average, have the following outcome:

2 will be profitable – with a value of £800 (20% x 10 trades x ££400 profit = £800)

8 will be losses – with a value of £800 (80% x 10 trades x £100 loss = £800)

Therefore over the course of 10 trades, I would expect to make nothing with this strategy.

I hope you can see how the combination of win rate with reward to risk ratio works and there is an imperative connection/dependency between these two factors and that they, when combined in the right way, will allow you to make profit.

So, once you have got a plan in place for risk management, and a trading strategy which combines win rate with risk to reward ratio to make profit, you will have your overall Trading Plan.

I hope you found this useful. If you have any questions please send me a message via the blog contact page. I do try to answer all queries if I can.

Please note any subscriptions taken via my affiliate link with Trading View may result in me earning a small commission. However, I provide complete transparency on me using Trading View personally – I publish my success on the financial markets via my broker reports and any profits earned were done so by using my own Trading View subscription, so I genuinely do recommend them and have been using the Trading View charts for many years.