In this article I’m going to explain in simple detail how to enter a trade in a margin spread betting or CFD account. I will explain how to enter a market order, set a stop loss and take profit/limit/target. I hope you find this helpful.

How to enter a trade

Entering a trade is quite simple but it should really tie up very well to your overall trading plan and strategy including your plan of managing risk. You can find articles on these on our blog here:

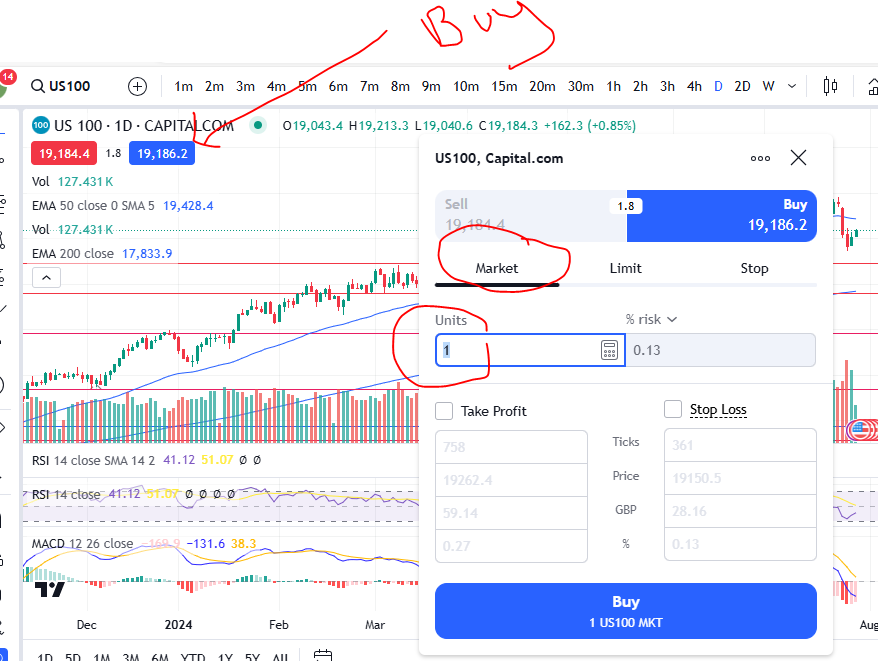

Right… getting back to how to enter a trade…if the above articles make sense to you, you can then choose to enter the market according to your strategy on your entry signal by opening up a deal ticket ‘market order’. A market order is an order which lets you enter the market immediately at whatever ‘buy’ price is displayed on your screen/chart. Let’s take a look:

First, I selected the blue ‘buy’ button. I use Trading View but you should find that your broker account is displayed/arranged in a similar way. This brings up a deal ticket and you can see the default is that it opens on the ‘market’ order tab – see the ‘Market’ heading circled and the number of units you are about to purchase. You will want to fix your stop and then control your number of units afterwards – see below. This is so that you can fix the amount you lose on each trade to be exactly the same, regardless of market and trade set up. I produced a video explaining this on Patreon, here:

How to set a stop and limit/take profit

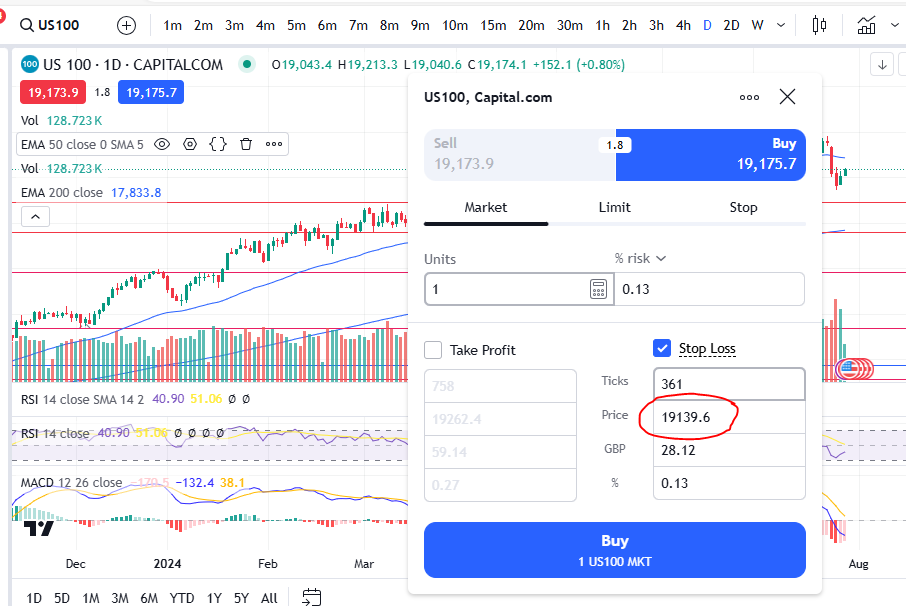

As stated above, it’s best to set a stop loss first. You should be aware of what ‘price’ you want your trade to exit the market at, should it go against you. See the section above on how to enter a trade. You can add this ‘price’ level to the trading view platform in the stop loss ‘price’ box, here:

In the above screen shot you can see that the ‘price’ level option is available for you to input a number. What you might find with some brokers, however, is that you need to choose an arbitrary ‘points away’ value and then adjust this on the chart by pulling the stop up or down on the chat, until it reaches the correct price according to your trade set up/strategy and plan. This was explained in my video on Patreon linked here:

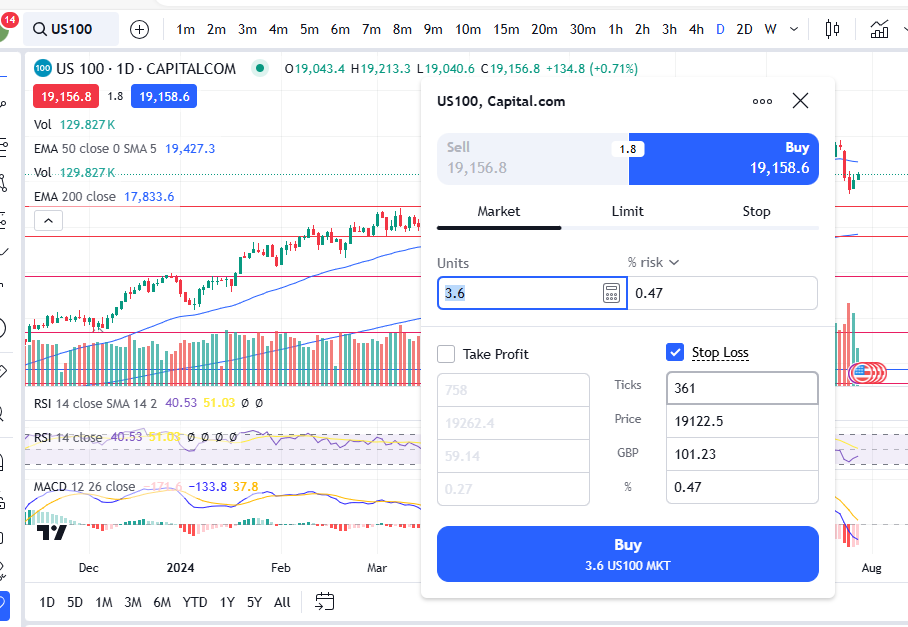

Once you have set your stop price, you should be controlling the ‘quantity’/number of portions of the market you want to open. This should be etched up or down until you get to the required stop loss ‘value’:

In this example, I have controlled the number of portions to be such that the value I lose on the above deal ticket would be no more than £100. Note that this is not always perfect – you cannot always fix it exactly to the number you want. The closest I could get this on this example was £101.23 rather than £100. This is ok – such a small difference in stop value will not have an impact on your win rate or the success overall, of the strategy.

Once you have set your stop loss and chosen the quantity, you can then set your limit in terms of price. As with the stop, some brokers will force you to choose a ‘points away’ value and then you may need to adjust this line on the chart to pull your limit/take profit target to the correct position.

Once your stop, quantity and limit have been set, you are good to go, and you can just click buy/enter.

I hope all of the above makes sense, and it’s clear how to enter a trade, but if you are stuck, please do reach out and I would be glad to help!

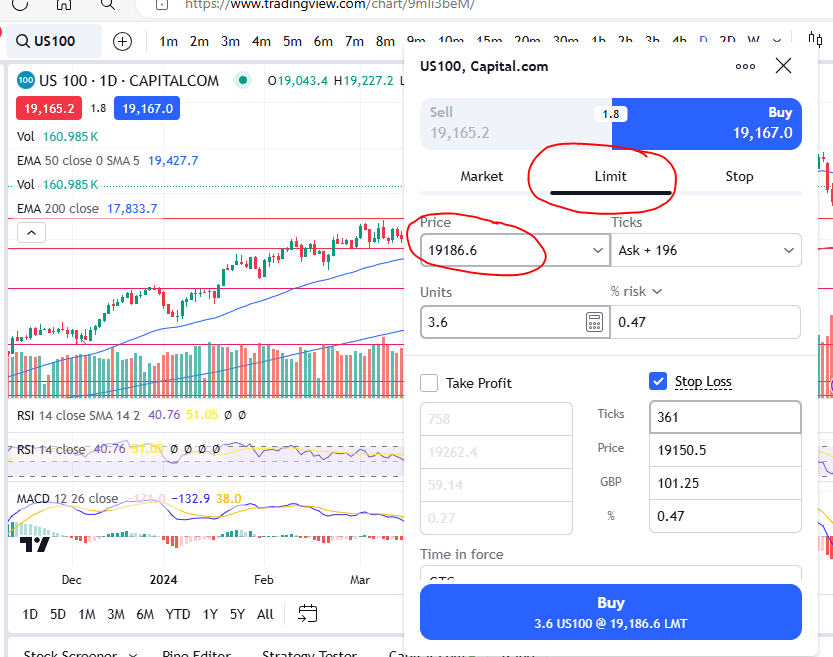

Entering the market at a chosen price

You can also enter a trade with a ‘limit’ order at a specific price. This will allow you to only enter the market at a given price, and if the market does not reach this required price, you will not enter. This will be exactly the same as the steps above but you will start by entering the ‘price’ at which you wish to enter the market, on a ‘Limit Order’ ticket, into the relevant box:

Once you have chosen the limit order and entered your limit price, the other steps will be the same as above for a market order.

I hope you found this article helpful.

For more great tips and advice on trading the stock market, please visit:

To watch me trade live please visit my Patreon page here:

https://www.patreon.com/Traderpro8320

Finally, if you would like to receive a discount on the Trading View charting software I use, please click on the relevant link here:

https://www.tradingview.com/?aff_id=117138

Please note any subscriptions taken via my affiliate link with Trading View may result in me earning a small commission. However, I provide complete transparency on me using Trading View personally – I publish my success on the financial markets via my broker reports and any profits earned were done so by using my own Trading View subscription, so I genuinely do recommend them and have been using the Trading View charts for many years.