In this blog article I will share with you a detailed description of what the RSI indicator is, how it works and how you can use it to assist you in achieving success in the financial markets.

What is the RSI Indicator?

The RSI indicator is a type of momentum indicator. It measures speed and the size of a market’s recent fluctuations in price. It can be used to evaluate under or oversold buying/selling opportunities. The indicator is an oscillator and has a scale of zero to 100.

How is the RSI indicator used?

As well as showing the user when a market is overbought or oversold, it can also tell the user whether a market is likely to have trend reversal or pull back. It can be used as a buy or sell signal. Typically if the readings on the RSI indicator are abovev70, this would indicate that the market is ‘overbought’ and it is not at that moment, presenting a ‘good deal’. If the readings are below 30, this indicates that the market is oversold (a bargain). When the readings are above 70, this might be a good time to exit a trade in a buy position, or wait until the price drops before entering one. When the RSI is below 30, this could be a good time for getting into a trade.

The RSI can also indicate whether the market is either uptrending or downtrending. The indicator may remain in the overbought teritory for a long time while the market is in an uptrend, and the opposite is true for downtrends.

The RSI indicator can be used to spot reversals. If the RSI is unable to reach 70 on a number of consecutive attempts during an uptrend, and then drops below 30, this could indicate that the trend is losing its strength and the price may reverse to lower levels.

How does the RSI indicator work?

The RSI indicator compares a market’s strength on intervals when prices go up to the market’s strength on intervals when the prices go down. The result of this comparison is an indication of how the market may perform in the future.

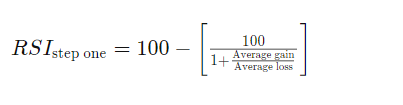

The RSI is calculated as follows:

The standard number of intervals used to calculate the RSI is 14.

Drawbacks

Despite being extremely useful, the RSI can give misleading signals when markets are either in a strong uptrend or downtrend. For example, if the market is uptrending, the RSI may not fall to near the 30 area at all… To combat this, the trader could ‘adjust’ his/her view in this scenario to note where the RSI falls to (which level) when it is at a low on the trend in an uptrend and vice versa.

The indicator works best in long term trends. It is however, most useful in an oscilatting market.

Lets take a look at some examples:

You can see in the chart for Natural Gas above, that each time the RSI falls below 30, this corresponds to a subsequent period of growth and the trend goes on to reach higher highs. Similarly when the RSI is especially high (see thepeak where the RSI extended beyond the purple area), this was followed by a sharp downwards move.

We hope you found this article helpful.

For a discount on the charting software I use, Trading View, please click on the following link:

https://www.tradingview.com/?aff_id=117138

To watch me trade the markets, please click on the following link:

For more great tips and advice on trading the financial markets, please see our other blog posts at:

Please note any subscriptions taken via my affiliate link with Trading View may result in me earning a small commission. However, I provide complete transparency on me using Trading View personally – I publish my success on the financial markets via my broker reports and any profits earned were done so by using my own Trading View subscription, so I genuinely do recommend them and have been using the Trading View charts for many years.