Hi guys

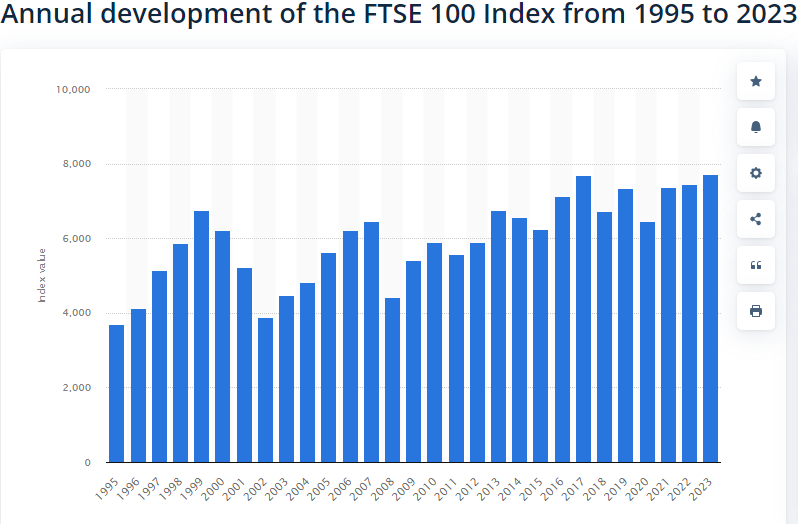

Just wanted to share some recent profitable trades I placed in May… May was a very good month for me. I’m sorry this is a bit late! The first thing to note is the direction of the overall market in May… See below screen shot of the NASDAQ and the S&P 500 on the daily timeframes. They were both in a nice uptrend with the MACD opening up:

Markets overall – recent profitable trades

I like to get into trades when the markets overall are about to make a MACD cross over or that has just happened. The S&P 500 was a bit slower than the Nasdaq – you can see the cross over was a bit bumpy and happened mid month!

Now lets take a look at some trades I placed:

Seagate – recent profitable trades

This is an IT company. The trade I placed on this one was not for beginners – it’s not in a nice strong uptrend currently. However, I knew the price was in a habit of bumping against the EMA line at at the point I entered on 9th May, it had reached another low, and we had just had a MACD cross over. I set my target for the EMA line as I knew there would be some resistance there. Sure enough it reached it’s target by 15th May and was profitable.

GOOGLE – recent profitable trades

This one was in more of a typical trading pattern for my sytle of trading. It had started uptrending strongly after reaching overall lows. There was a support level at around the moving average cross overs and I entered at this point on 9th May, when the MACD was just about to cross. The price reached up out of a consolidation zone and hit it’s target on 11th May.

Easyjet

This was another one which was not in my typical trading pattern….. I don’t usually trade consolidations. You can see the price was moving sideways between quite a narrow channel. It made a MACD cross over at my entry point and I set my target for previous highs. This one was another profitable trade.

GOLD:

30m timeframe:

This trade was very typical of what I look for and it was profitable. I first checked the daily timeframe to make sure that the price was uptrending in the candles and the MACD. On the daily timeframe the price had just bounced away from a support level with a MACD cross over below the zero level of the histogram. Next I zoomed in and got in and out of the trade using the 30 minute timeframe above. I waited for a MACD cross over on the 30 minute timeframe and set my target for around the previous high.

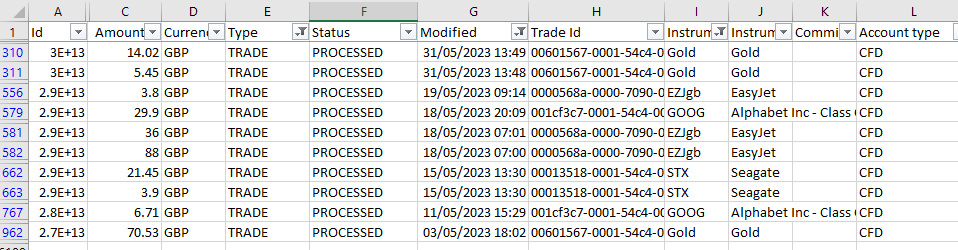

For transparency I have copied below the relevant entries in my trading account.

Just to be clear, not all trades were profitable in May. I made a loss on Shell and a couple of other markets.

I hope you enjoyed this digest. Please check our other blog posts for helpful trading tips and resources: Trader Pro – Trading strategies for success in the financial markets (trader-pro.co.uk)

If you would like to use the charting software above, we highly recommend Trading View to you. Use the following link and you may receive a discount on your subscription: https://www.tradingview.com/?aff_id=117138&source=TraderProBlog

Please note any subscriptions taken via my affiliate link with Trading View may result in me earning a small commission. However, I provide complete transparency on me using Trading View personally – I publish my success on the financial markets via my broker reports and any profits earned were done so by using my own Trading View subscription, so I genuinely do recommend them and have been using the Trading View charts for many years.