In this article I’m going to talk about how to avoid losing money with the spread and how it can affect your trading. It can block you from getting into trades if you are not careful, cause you to hit your stop more easily, and it may even result in you feeling frustrated with your broker, if you are not aware of what is likely to happen in advance and you have less of an understanding about the spread than an experienced stock market trader.

How the spread can affect your trading – How to avoid losing money with the spread

In short, the spread is the number in between the price to buy or sell. It is the ‘margin’ of profit which the broker makes between the buyers and the sellers. Since it is controlled by the broker, it is possible for the broker to change the spread at any moment “according to the risk in the market”… I put that last part in inverted commas because it does allow the broker to manipulate if they choose to and it is very difficult for the regulators to regulate this… New traders can feel like the price has been moved ‘deliberately’ to hit their stop, especially where it goes on to reach their original target and it was just because of the spread, that the trade was a losing trade.

Avoid losing money with the spread – Who needs to worry about the spread?

The spread is something which day traders need to be especially concerned with. It should not affect people who trade the higher timeframes so much but they should at least be aware of how it is possible for the spread to affect a trade. Why does it affect the smaller time frames more? This is because it represents a larger portion of the proft target/where you want your position to move from and to on the smaller timeframes. On the larger timeframes, like the daily timeframe, the spread will seem insignificant.

Does the spread cause you to lose trades? How to avoid losing money with the spread

Yes and no! It does for newer traders because they are not aware necessarily of what it is, or how it can affect their trades. It can for day traders too – especially if they are unware of it or they are not paying it the attention it deserves. It shouldn’t do for people who trade the daily timeframe so much – but it depends on the size of the spread and this is unique to each market!

Lets take a look at how the spread can affect trade set ups

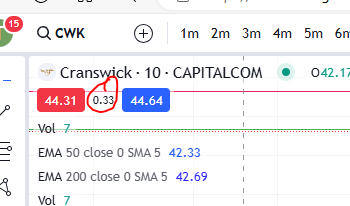

Let me give you some examples… I have deliberately picked a stock with a large spread. I have chosen a small timeframe trade set up to illustrate how it can affect you… Consider the trade set up below. I typically like to enter a market after a MACD cross over. I like to take profit at the previous high (or at 1.5 x my risk) and set a stop at the previous low. Let’s take a look at how you can avoid losing money with the spread in relation to trade set ups:

As you can see in the above picture, the planned entry would have been at 43.51 and this would have left plenty of room to make a profit up to the target price of 43.84. The risk to reward ratio on that set up without the spread would have been quite good (you can see the place I would have set my stop and that the stop distance is a lot smaller than the profit target distance). However, once you add in the spread, on entering the market, your entry price would bump up to where you wanted to put your profit target. It has completly anialiated your trade set up. At that point you could proceed with the trade, and end up risking more than you will win, or you could exit the trade in a loss (because you have just effectively paid for the spread – to the tune of where the chart has bumped you upto!).

Can the spread affect your win rate?

In a word, yes. The chances of you hitting your target can be affected by the spread. It depends a bit on how you have set your chart – is your chart showing you the price ‘inclusive of the spread’ for a sell order, or the price exclusive of the spread? Lets take a look at what can go wrong with this and how you can avoid losing money with the spread specifically in relation to win rate:

Using Cranswick again as the example, lets say you wanted to sell at the price of 43.90 but your chart is showing you the price excluding the spread. It may not be obvious to a new trader that the price may never get to their target, because they would need to reduce the target by the spread to make sure it will get there before hitting resistance and coming back down. In the example above, while the normal (exclusive of spread) chart is showing the price is at 43.90 the position held with the broker will only show that the price is at 43.52 so the trader may find him/herself in a position where the price never ends up reaching the target and it’s possible it will go back down from there and hit the trader’s stop. This can therefore affect the trader’s win rate! At this point, some new traders will be extremely upset and frustrated with their broker because they do not understand how the spread works or how to set up their charts properly! What was planned to be a profitable trade, will end up being a losing trade, simply because the spread was not taken into consideration.

So what can you do to combat these problems with how the spread affects your trading?

In short, you can avoid losing money with the spread by making sure you are aware of where the spread inclusive price is before making decisions, you can set your charts to show you the price inclusive of the spread, whether that’s a buy or sell (you may need to keep switching between the two, so show the ‘buy inclusive price’ at entry, and then when you are waiting to sell, change the chart to show you the ‘sell inclusive price’) but you would in any event, need to be aware of the distance of the spread in general, before placing the trade, so you can analyse whether or not the cost is just too great and whether it will completly anialate your trade setup or not!

Another way to combat the spread is to simply avoid markets where the spread is high! I delieberately chose Cranswick to illustrate these examples because I know that the spread is high on this market. However, you could probably safely trade one of the more popular markets, even as a day trader on the smaller timeframes, without getting into too much difficulty – for example, markets like Apple, Microsoft.

Also know that the spread moves around at times of genuine volatility – such as during interest rate hike decisions being made in FED/bank meetings, major news etc. It may be a good idea to avoid trading markets with higher spreads at these times because the fluctuations will make the spread even worse on all markets.

I hope you found this article on how to avoid losing money with the spread, helpful.

For more great tips and advice on trading the stock market, please visit:

To watch me trade live please visit my patreon page here:

https://www.patreon.com/Traderpro8320

Finally, if you would like to receive a discount on the Trading View charting software I use, please click on the relevant link here: