Lets take a look at some of the opportunities Trader Pro took advantage of. Below you will find the breakdown and thought process behind some recent profitable trades. Enjoy!

Natural Gas – 30m timeframe – recent profitable trades

Natural Gas is starting to creep up after much time of consolidation. See the daily timeframe chart below. Here’s what the chart looked like before I jumped into my trade:

The trading timeframe I used was the 30 minute timeframe. You can see on the daily chart that the price hit a new high and then came back down to the 50 period EMA and started to find support. This is where I was looking to get in – with a profit target around the red resistance level noted on the chart above.

Now lets take a look at the 30 minute timeframe:

I entered the trade as per the trade diagram above. The MACD was just crossing over, the RSI had reached a low point, the price was trading above the 50 period EMA. Profit target for around the resistance level as noted with the red horizontal line on the chart (per daily timeframe).

Lets see what happened next:

As you can see, as predicted, the price rose to the resistance level and burst through it. It became overbought at that point and began to lose momentum. I had exited by this point.

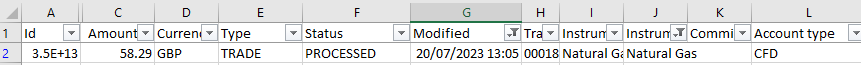

As previously, I like to share the reports from my trading platform so that you know these are genuine trades which were placed by Trader Pro. Lets take a look at my exit per my trading reports:

I hope you enjoyed this blog post and that it helps goes some way to helping you understand multiple timeframe analysis and how to view the markets and identify opportunities taking all the different factors into account – timeframes, entry indicators, other useful information – how overbought or oversold a market is etc, where to set the profit target and stop loss.

Happy trading!

For more great tips and trading advice go to:

If you would like to use the charting software above, we highly recommend Trading View to you. Use the following link and you may receive a discount on your subscription: https://www.tradingview.com/?aff_id=117138&source=TraderProBlog

Please note any subscriptions taken via my affiliate link with Trading View may result in me earning a small commission. However, I provide complete transparency on me using Trading View personally – I publish my success on the financial markets via my broker reports and any profits earned were done so by using my own Trading View subscription, so I genuinely do recommend them and have been using the Trading View charts for many years.